To safeguard against these risks, companies typically secure Management Liability (ML) Insurance for private companies, which encompasses Directors & Officers (D&O) Insurance, or standalone Directors & Officers insurance if the company is publicly traded. This coverage is designed to protect directors, officers, and senior managers from claims alleging wrongful acts in managing a company.

Why is D&O Insurance Purchased at the Company Level?

D&O insurance is structured to offer protection for individuals at the helm of an organisation. Since directors and officers make decisions on behalf of the company, the organisation purchases this insurance to provide collective coverage. The policy typically covers defence costs, settlements, and legal fees arising from claims such as:

- Regulatory investigations (e.g., Australian Securities and Investments Commission (ASIC) inquiries)

- Claims of mismanagement (from shareholders, creditors, or employees)

- Breach of duty allegations (including negligence claims)

- Legal defence costs (for proceedings related to corporate decisions)

It’s important to note that typically individual directors cannot purchase separate D&O policies; the coverage is obtained by the company.

Before Accepting a Director Role – Review the Company’s D&O or Management Liability Policy

If you’re considering a directorship, it’s prudent to request and review the company’s Management Liability or D&O policy before joining. This allows you to:

- Assess Coverage Limits: Ensure they are sufficient to cover potential legal costs and claims.

- Identify Exclusions: Be aware of any significant gaps in protection.

- Confirm Coverage Scope: Determine who is covered under the policy (e.g., past directors, committee members, subsidiaries).

- Understand the Claims Process and When to Notify the Insurer: Familiarise yourself with the procedure in case you need to rely on it

Not all ML or D&O policies are the same, and assuming you are covered without reviewing the details can be a costly mistake.

KBI Can Assist with Reviewing or Securing the Right Cover

Navigating D&O insurance can be complex, and ensuring you have the right protection is critical. KBI specialises in providing tailored advice and solutions in this area. We can assist by reviewing existing D&O or Management Liability policies and helping directors secure appropriate coverage if additional protection is required.

If you’re taking on a director role or want to ensure you have adequate cover in place, contact KBI to discuss your options.

For more detailed information on Management Liability Insurance, visit our Management Liability Insurance page.

Disclaimer:

KBI PTY LTD is an Authorised Representative (450152) of KBI Group Pty Ltd (ABN 56 167 437 121, AFSL 494792). Any advice in this article is general in nature and does not take your personal circumstances into account. When considering the purchase of an insurance policy, you should consider whether the advice is suitable for you and your personal circumstances. Before you make any decision about whether to acquire a certain product, you should obtain and read the KBI Financial Services Guide and relevant product disclosure statement.

Understanding D&O Insurance

| Directors and Officers (D&O) insurance is an essential coverage designed to protect the personal assets of directors and officers of a private or public company. This type of insurance provides coverage for claims that arise from alleged wrongful acts committed by directors and officers in their capacity as company executives. D&O insurance, or sometimes referred to as directors insurance, typically covers claims related to negligence, errors, omissions, breaches of fiduciary duty, and misleading statements. These legal investigations or allegations of wrongdoing are typically brought by shareholders, employees, regulators, creditors, competitors, liquidators, and other interested parties. D&O Insurance can also be extended to cover the company for employment practices liability, statutory liability, and company security liability to protect the balance sheet of the company.

One of the primary benefits of D&O insurance is that it offers financial protection to directors and officers facing legal action. In the event of a claim, the insurance policy can help cover legal defence costs, settlements, and judgments. This is especially important as legal expenses can quickly add up, and the personal assets of directors and officers may be at risk without adequate insurance coverage. Note that legislation has recently changed, which limits the extent that insurance can pay towards fines and penalties. | Moreover, D&O insurance not only safeguards the personal assets of directors and officers but can also provide a layer of protection for the company itself. Having D&O insurance in place can enhance the company’s reputation and credibility, as it demonstrates a commitment to risk management and corporate governance. It helps attract and retain top-tier talent for executive positions, as individuals are more likely to accept leadership roles when they know their personal assets are protected. |

What does Directors and Officers Insurance Cover?

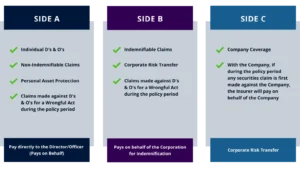

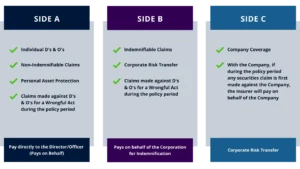

| D&O policies are typically structured with three available insuring clauses – Side A, B & C. | We explain the insurance coverages below: |

Side A Coverage (Directors & Officers/Insured Persons)

| Insurance protection for the Directors and Officers when indemnification (through the Corporate Deed of Indemnity) is not available to the Directors and Officers of the company resulting in a personal liability risk. | Its sole purpose is to protect the individual directors and their personal assets and is the final protection if the company is unable to indemnify the Directors & Officers itself. |

Side B Coverage (Company Re-Imbursement)

| Insurance protection for the Company when they indemnify a Director and/or Officer of the company, in the form of a reimbursement from the insurer. | Side B is a form of balance sheet protection for the company and the transfer of the indemnity exposure that is agreed in the company’s Deed of Indemnity. |

Side C Coverage (Entity Securities Liability)

| Insurance protection for the entity’s own liability, specific to securities laws. It is balance sheet protection in the event the company is also named in a securities claim. Please note that some insurers are no longer offering side C coverage due to increased claims activity over recent years in Australia. | Where it is offered it is still often at prohibitively high premium rates. Have a look at our “how does D&O insurance work” article to understand how a D&O policy responds. |

Understanding ML Insurance

| Management Liability (ML) insurance is another form of coverage that is designed for small to medium sized organisations. ML insurance is designed to protect the management team as a whole, which includes not only directors and officers but also other key executives involved in decision-making processes. It is often referred to as “Directors & Officers Insurance for Private Companies” but it is actually more than that, as it packages up comprehensive coverage for various liability exposures faced by the management team.

One of the key advantages of ML insurance is its extensive scope of coverage. In addition to the protection offered by D&O insurance, ML insurance encompasses a wider range of risks. This includes coverage for employment practices liability, which protects against claims related to wrongful termination, discrimination, harassment, and other employment-related issues. ML insurance also provides fiduciary liability coverage, which addresses claims arising from breaches of fiduciary duties, mismanagement of employee benefit plans, and other similar exposures. | By securing ML insurance, companies can provide comprehensive protection for their management team, ensuring that key executives are shielded from a wide range of liability risks. This coverage not only helps attract and retain top talent but also mitigates potential financial losses that could arise from legal actions or unforeseen circumstances. |

What does Management Liability Insurance Cover?

Management Liability / Directors and Officers Liabilities

| This section provides cover for the mismanagement of the company resulting in a legal action (lawsuit) against the company’s directors & officers. |

Crime Protection

| Management liability insurance covers a range of crime related occurrences when there has been a direct financial loss. | This can include employee fraud or dishonesty, third party crime, electronic and computer crime, destruction and damage of money, crime by shareholders. |

Employment Practices Liability (EPL)

| This section covers the directors/officers for an alleged Employment Practices breach. | These can include wrongful/unfair dismissal, harassment, discrimination, bullying, whistle-blower. |

Additional ML Coverages

| Additional management liability coverages that can be added to the initial coverage include: ➤ Tax Audit Costs ➤ Identity Fraud Expenses ➤ Inquiry / Prosecution / Crisis Costs ➤ Pollution Defence Costs |

The Differences between D&O and ML Insurance

| Coverage Focus: D&O insurance specifically focuses on protecting directors and officers from personal liability arising from their actions or decisions as executives. Some, not all D&O policies drop down to cover employees. ML insurance, on the other hand, provides coverage that extends beyond directors and officers to cover the entire management team for a wide range of matters.

Scope of Coverage: D&O insurance provides coverage for personal liability, including claims related to negligence, errors, omissions, breaches of fiduciary duty, and misleading statements made by directors and officers. ML insurance can cover a broader range of coverage for multiple liability exposures faced by the management team, such as employment practices liability, fiduciary liability, and crime liability. | Size of Company: ML Insurance is predominantly designed for small to medium sized organisations. D&O Insurance is more suitable for ASX listed or larger public unlisted companies. Most ML policies exclude cover for capital/ securities raising so it is very important to consider the company’s plans for the future when securing the appropriate cover so that any raisings are covered under the policy. |

When to Consider D&O Insurance

| D&O insurance is essential for businesses that have a board of directors or officers who make crucial decisions that impact the company’s operations and stakeholders. It is particularly relevant for publicly traded companies, as directors and officers are exposed to higher risks and potential shareholder litigation. | However, even private companies can benefit from D&O insurance to protect their executives’ personal assets and attract qualified directors and officers. |

When to Consider ML Insurance

| ML insurance is necessary for businesses that want comprehensive coverage for their management team beyond directors and officers. It can cover the additional risks faced by the management team, such as employment practices liability, fiduciary breaches, and crime liabilities. | ML insurance is particularly relevant for businesses of all sizes and types, as it provides broader protection against a wide range of management-related risks. |

Partner with KBI for Effective Premium Management

| Partnering with KBI, a specialist insurance brokerage, is a strategic choice for effective insurance management.

Because KBI are specialists brokers in a specific industries, our specialised experience and expertise equips us to assist you in seeking suitable premium rates for your business.

At KBI, we understand that every business is unique and has specific insurance needs. Our dedicated team of insurance brokers will work closely with you to understand your risk profile and design customised insurance solutions tailored to fit your needs. We have deep industry knowledge and access to a wide network of insurance providers, allowing us to be more effective in negotiating for more competitive premiums. | Our commitment to proactive guidance and support in risk management sets us apart. We will assist you in implementing effective risk mitigation strategies, ensuring that your business is well-prepared and resilient against potential threats. In the event of an incident, our swift incident response and claims management services will help minimise the impact on your business operations and facilitate a smooth claims process.

Staying informed is crucial in navigating the insurance landscape. At KBI, we provide regular product updates and industry insights through our communications channels, including our website and blog. We keep you informed of changes in the insurance market, emerging risks, and best practices to empower you with the knowledge needed to make informed decisions.

|

Historical Perspective

| Historically, the D&O market was less challenging, with lower premiums, higher limits, and broad coverage offered by insurers. | However in the last 5 or so years, increased claims activity, class actions, and regulatory scrutiny including a number of Royal Commissions have made the market more challenging. |

Recent Challenges

| D&O insurers have responded by reducing capacity (limits), issuing more stringent terms, reducing cover, and increasing premiums/retentions. | This has created a challenging environment for businesses looking to obtain D&O insurance, with underwriters considering various factors before issuing a policy, including the financial stability of the company, business sector and vulnerability to an economic downturn. |

2023 Outlook

| The 2023 outlook for the D&O market is expected to stabilize, with occasional rollover premiums and smaller increases as the market pulls back from the harsh remediation of their portfolios. The challenging environment of the last few years has created the perfect opportunity for new entrants into the market and we are seeing more competitive tension in the space. New entrants into the market may be able to offer more competitive premiums as they are not still having to remediate their portfolios which may have suffered more claims over the last challenging period. | “The 2023 outlook for the D&O market is expected to stabilize, with occasional rollover premiums and smaller increases.” |

Underwriting Considerations

| There are still particular issues impacting the market, including the general economic downturn, work-from-home arrangements, work health and safety concerns, increased scrutiny from ASIC on directors’ duties, greenwashing, and share trading. Insurers want to exercise some caution when reviewing new risks to identify what the particular risk areas are for businesses and what steps the Board is taking to mitigate against those risks. | When considering whether to offer terms on a particular risk, underwriters consider several factors, these include:

• Board composition, • Industry sector and the business cycle (start-up versus established businesses), • Corporate governance, • Financial information (e.g. the presence of significant debt on the balance sheet and restrictive covenants/terms); • Foreign jurisdiction exposure.

These factors influence the insurer’s threshold decision – to offer terms or not, but also affect the terms and exclusions applicable to the policy. |

Helpful Advice for Companies Seeking D&O Insurance Coverage

| Helpful advice for companies seeking D&O insurance coverage includes:

• Scheduling underwriter meetings either face-to-face or via Zoom, • Ensuring that the right business representative is in the meeting to answer questions about the business fundamentals, | • Pre-empting underwriting questions by having a good understanding of the company’s risk management framework and policies and procedures; • Being on the front foot with cash flow forecasts and strategy updates. |

Conclusion

| Once a policy option is secured, the Board should also ask the broker questions about the policy in order to understand the general cover and any endorsements so they can query changes in cover year to year. When the broker and client understand the policy, they can consider factors that might help the insurer gain more comfort about the risk potentially broadening the cover. | The D&O market has undergone significant changes in recent years, creating a challenging environment for businesses looking to obtain coverage. However, with a better understanding of the underwriting considerations and helpful insurance broking advice, businesses can be better prepared when seeking D&O insurance coverage. |

What does Directors and Officers Insurance Cover?

| Claims of mismanagement or breaches of a company’s fiduciary duties are covered by D&O insurance. These legal actions or investigations of wrongdoings are typically brought by shareholders, employees, regulators, creditors, competitors, liquidators. D&O Insurance can also be extended to provide entity coverage against employment practices liability and statutory liability. | A D&O insurance policy is a second line of defence to indemnification and typically forms part of a corporation’s full indemnity program. Regardless of whether the corporation defends the directors and officers or not, D&O insurance is there to protect the directors if they face any lawsuits. Common payouts from D&O insurance cover the losses associated with monetary demands such as defence and settlement costs. |

D&O Insurance Policy Structure

| D&O policies are typically structured with three available insuring clauses:

i. Side A Coverage – Directors & Officers / Insured Persons | Here’s what a typical D&O policy structure looks like: |

Side A Coverage – Directors & Officers / Insured Persons

| Side A coverage exists to protect the directors and officers of a company if they face personal liability risk when company indemnification is not available to them. The sole purpose of Side A policy is to protect the personal assets of directors and officers and not the corporation. This insuring agreement is the final protection should the company be unable to indemnify its director or officer itself. It’s worthwhile noting that there is no deductible with Side A coverage. | Claims example

|

Side B Coverage – Company Reimbursement

| If the corporation is able to indemnify its directors or officers, then Side B coverage provides the company reimbursement for its expenses in doing so. Side B coverage acts as a form of balance sheet protection to the company. It enables companies to transfer their responsibility for certain liabilities and costs to the insurer under a deed of indemnity between the company, and its directors or officers.

It’s important to note that Side B coverage comes with a ‘deductible’, also referred to as an excess. | Claims example

|

Side C Coverage – Entity Coverage

| Side C coverage offers insurance protection for the entity’s own liability. Many insurance providers do not offer this cover due to high claims history over recent years.

Australia’s ever-increasing regulatory system, and most recently the unpredictable impacts of COVID-19, have seen corporations operating in an environment with frequent regulatory change and increased regulatory oversight. The rise in Royal Commissions and public awareness has also brought about heightened community scrutiny, which opens more windows of opportunity for claims and investigations brought against not only directors and officers but claims specific to securities law against the company, too.

It’s important to note that the scope of protection that Side C offers is different between policies that are for private companies and those for publicly traded companies.

For private companies, Side C coverage provides entity coverage for lawsuits against the corporation itself. This also includes not-for-profit organisations or strata corporations such as homeowner associations. Publicly traded companies however benefit from Side C coverage’s protections for its own liability arising from securities claims. | Claims example

The company would then make a claim under its D&O policy, where Side C would cover the expenses associated with defending itself throughout the class action. This helps protect the entity’s balance sheet. |

Directors and Officers Insurance Exclusions

| Directors and Officers exclusions can be categorised into two types — Standard Exclusions that are built into the policy wording and Customised Exclusions that are endorsed onto the policy by insurers. | It is crucial to understand your Directors and Officers policy and its specific exclusions. Insurers underwrite all public company Directors and Officers policies, and they will add customised exclusions as they deem fit. It is important to understand what these exclusions mean and if there are any reporting requirements. |

Standard Exclusions

| There is a list of standard exclusions that you can expect to see on your D&O insurance policy, which may include:

|

|

Customised Exclusions

| Customised exclusions within your D&O policy structure may include:

|

|

| The complexity, intricacy, breadth and scope of D&O insurance policy structures call for specialist guidance regarding your risk management. At KBI, we have placed Directors and Officers Liability Insurance for over 300 public companies throughout Australia, Asia and North America. Our experience with not-for-profit organisations and private companies is also reputable. We offer tailored D&O insurance policy structures to suit your individual needs. | Allow us to provide some tailored information – obligation-free! |

| If a company has the financial capacity to offer a comprehensive deed of indemnity to the director, the contractual agreement between the company and the director is most important. This is still considered the best first line of defence to help cover or indemnify a director against personal liability. Side B cover (Company reimbursement) of the D&O policy can reimburse the company where it has provided indemnity to the Directors. | Directors & Officers Insurance assists in situations where the company’s financial situation cannot accommodate a deed of indemnity; for example, the company is insolvent or near insolvency. It also serves to cover a class of liabilities where indemnification is prohibited. |

Duties of Australian Company Directors

| There are a number of legal obligations that come with being the director of an Australian company. These are in place to protect the stakeholders of the company and must be adhered to.

Some of the legal obligations a director must follow include the duty to: |

For a comprehensive list of directors duties, see the Corporations Act 2001. |

Vicarious Liability

| In the case of a company breaching relevant laws or legislation, the director may become personally liable in some circumstances. This is called vicarious liability and may be imposed upon the director if they were in force at the time the company breached the law. Vicarious liability can be brought about by breaches of various laws, including the following:

|

|

Due Diligence of Company Directors

| Directors must undertake due diligence to identify any risks in the company and manage them appropriately. Regarding directors’ duties and vicarious liability, due diligence can help to establish protocols and processes to ensure the smooth running of a company. Undertaking due diligence not only reduces errors and harm to stakeholders but can also help protect directors from liability. | A keen understanding of duties, WHS and other legislation, is needed so the director can ensure the company is following all protocols to reduce risk and liability. D&O Insurance can help to minimise the risk of financial penalty in many circumstances, but not all. |

Consequences of Breaching Directors Duties

| Breaching Directors’ duties results in some serious consequences, including both Civil (monetary penalty imposed as a result of civil proceedings) and Criminal (criminal sentence, penalty or fine imposed) penalties:

Breaches resulting in Civil Penalties

| Breaches resulting in Criminal Penalities

Most D&O insurance policies include a general exclusion for claims:

|

When Indemnity is Prohibited

| A company is able to financially protect directors against some liabilities, but not all. Indemnification and exemption of an officer or auditor by a company is limited by or prohibited in certain circumstances under s199A of the Corporations Act.

When Indemnities for liabilities are not allowed (other than legal costs)

A company or a related company must not indemnify a person (directly or through an interposed entity) against any of the following liabilities incurred as a director of the company:

A key concern for directors when defending an action is whether the company can assist with indemnity for legal costs. S199A(3) prohibits this in the following circumstances: | When Indemnities for legal costs are not allowed

A company or a related company must not indemnify a person against legal costs incurred in defending an action for a liability incurred as a director of the company if:

|

A typical D&O policy

| In most instances, a director or officer will be covered by the Side A component of the D&O Insurance policy (KBI D&O policy structure) for general liabilities and legal costs where the company may not indemnify. There is a prohibition in Section 199B of the Corporations Act which prohibits a company from paying premiums for an insurance policy which indemnifies a director against liability for:

| The central theme of the prohibitions under s 199A and s 199B of the Corporations Act is that they focus on conduct towards the company itself or conduct accompanied by lack of good faith, intention, and wilful breach. |

Work Health and Safety Breaches

| The legislation regarding insurance and WHS differs slightly across Australia’s states and territories as they each have their own WHS Acts. Be sure to familiarise yourself with your state’s specific legislation.

In 2020 New South Wales amended their WHS Act to include the prohibition of entering into an insurance policy that intends to indemnify the person from their liability to pay a fine or an offence under the WHS Act. This law extends to insurers, making it illegal to issue a policy covering WHS breaches. Western Australia has followed suit by overhauling their Act, prohibiting insurance against WHS breaches.

WA’s Work Health and Safety Act 2020 brings with it the creation of the criminal offence, Industrial Manslaughter, which requires the following elements:

| Western Australia and South Australia are the most recent states to introduce a specific charge of Industrial Manslaughter, bringing them in line with Queensland, the ACT, Northern Territory and Victoria. New South Wales does not specifically have a charge for Industrial Manslaughter, but their WHS Act has been updated to include Manslaughter offences linked to workplace incidents. Tasmania is now the only state without an Industrial Manslaughter offence.

Directors have a duty to exercise due diligence to ensure a PCBU (Person Conducting a Business or Undertaking) complies with their obligations. Basically, the director is responsible for ensuring the company is keeping its workers safe. The duty imposed is a positive duty requiring a proactive approach by directors to ensure they comply with the obligations under the legislation. Failure to comply now brings harsher consequences with the prohibition of insurance and introduction of Industrial Manslaughter, with a maximum imprisonment term of 20 years for individuals and a fine of $5M, or a $10M find for a Body Corporate.

|

D&O insurance

| D&O Insurance is becoming increasingly difficult to obtain at competitive pricing. Cover is being scaled back due to reductions in capacity and changes in underwriting guidelines. As legislation develops, Directors & Officers will need to examine the structure of their D&O Insurance policy at every renewal. It is essential to revisit the gaps that may exist between their Deed of Indemnity and the D&O Insurance, keeping a careful eye on any areas of exposure. | At KBI, we can guide you when structuring your policy in a way that brings optimal risk minimisation. Talk to KBI about your D&O Insurance requirements.

|

Table of Contents

| Who Shares the Policy? What’s Covered in the Policy? What does Aggregate Limit mean? | What is the Structure of the Policy? Range of Factors to Consider When Setting the Limit Setting the Limit |

Who Shares the Policy?

| The policy limit is a shared limit for Insured Persons, this covers Directors and Officers (C-Suite management) and the company (if Side C is present). |

What’s Covered in the Policy?

| The limit of liability includes settlements and court awarded judgements and defence costs, which would otherwise need to be paid by the company or its executives. |

What does Aggregate Limit mean?

| The aggregate limit is the limit of liability available to each individual claim as well as all claims in the aggregate ie one large claim could erode the entire limit for the policy period and the aggregate limit typically doesn’t have a reinstatement. |

What is the Structure of the Policy?

| A typical D&O policy includes the following covers: |

|

|

There are a range of factors to consider when setting the limit

| ➤ Public / Private and Market Capitalization Generally speaking, the larger and more sophisticated a business the higher the risk, however there are some private companies that should consider a higher limit based on the degree of exposure of a particular project or enterprise they carry out. ASX top 100/200 are obviously the main targets for class action law suits and disgruntled minority shareholders.➤ Percentage Owned by Insiders Where directors and significant associated shareholders hold a large percentage of the issued share capital this may affect the decision on the limit. If directors hold a large proportion of the issued capital it may be argued that this reduces the scope and potential quantum of damages by claimants. Generally D&O insurers will include an endorsement aimed at excluding internal disputes between insiders for example the major shareholder exclusion (sometimes with a board seat). This excludes cover for the major shareholder suing the board or the company as they are expected to be helping direct the company and would be typically considered insiders. ➤ Peer Group

➤ Regulatory Framework

➤ Company’s Capacity to Retain Risk | ➤ Insolvency Risk At certain times in the company’s development the dependency on outside equity or debt may increase the risk of insolvency. At these times the company may consider a higher limit is justified. Certainly, the Directors and Officers might consider whether the company would be able to fulfil its indemnification obligations in the foreseeable future.➤ Merger & Acquisition Exposure The company’s growth plans may affect the limit decision. If the company’s strategy includes growth by acquisition or places them in circumstances where they may be subject to merger or acquisition themselves, they may consider a higher limit as these are inherently riskier activities. ➤ Cost / Budget

➤ High / Low Risk Industry or Jurisdiction

➤ Availability |

Setting the Limit

| Once the above considerations have been taken into account we believe that setting the limit is a process reached between the board and an experienced broker. The interplay of the market capitalisation of the company, the free float of shareholders and average damages settlements (including defence costs) are all taken into consideration when reaching what we consider to be a minimum limit for the Board. Once this is identified the broker needs to work to secure the best available terms for the Board’s requirements. | Given the challenging insurance market and the likelihood of significant changes to the company’s business (for example in light of COVID and the overall economic downturn), we recommend that the Board revisit the limit every year in conjunction with an experienced D&O broker. |

1. Officer

| Directors and Officers Insurance policies, as the name suggests, cover both the Directors and key Officers of the company. The definition differs across insurers but generally includes a person who participates in decision making that affects the whole, or a substantial part, of the business of the Company. | We would include the CFO, COO, CEO and Company Secretary as Officers. |

2. Wrongful Act

| While the term indicates a positive act, the definition of a wrongful act also contemplates an omission or failure to act. | D&O insurance policies usually include in the definition; a misstatement, misleading statement, a breach of duty or trust and mistakes/errors made by the Board or officers. |

3. Side AB

| Side A is the first insuring agreement of a D&O policy. It insures executives from claims where the organisation has not indemnified them (either because it is not in a position to or where it is legally prohibited from doing so). | Side B, also known as corporate reimbursement cover, is the second insuring agreement of a D&O policy and reimburses an organisation for the expenses incurred in defending its directors and officers. |

4. Side C

| Some D&O policies include a third insuring agreement, Side C, also known as entity securities coverage. Side C insurance responds to claims made against a company as a result of the offer, sale or purchase of its securities. | See here for the structure of a typical D&O policy. |

5. Retention

| Also known as a deductible, this is the payment that the insured pays first before the insurer’s payments commence. | Generally speaking, Side A attracts no retention, Side B has a moderate retention (on the basis that companies generally have the resources to pay the retention) and Side C carries a larger retention. |

6. Securities Threshold

| Commonly included as an endorsement by insurers. This is the maximum capital raising threshold for which cover is automatically extended under the policy. | The insured should notify the insurer of any raisings above this threshold and they would be entitled to charge an additional premium to underwrite the raising. |

7. Continuity

| Generally, continuity of coverage allows a claim notification to be accepted late provided the policyholder has held uninterrupted D&O insurance cover for a period of time. | This is often a convincing reason to remain with your incumbent insurer. In some circumstances your broker can negotiate with an incoming insurer to match this. |

8. Extended Reporting Period

| This is a time period after expiry of the policy, where the insured can notify claims to the insurer as if they were lodged within the policy period. | This usually attracts an additional premium. |

9. Investigation

| Also referred to as an inquiry and includes administrative or regulatory proceedings (official or otherwise) depending on the policy wording. | This doesn’t include an ordinary or internal routine matter. |

10. Change in Control

| A change of control can be any of the following:

| Insurance policies usually provide that in the event of a change in control the policy will be placed into run off (unless this provision is overridden). |

11. Run Off

| Following a change in control, an organisation’s D&O policy will convert into run-off. The policy will then only respond to claims arising from wrongful acts prior to the date of the change in control. | See our blog post on Run-Off available here. |

12. Major Shareholder

| Commonly seen as an endorsement/exclusion on D&O policies the major shareholder exclusion intends to exclude coverage for any claims by a claimant who owns over a certain percentage of a company, typically 10-15%. | The reason for this endorsement is to avoid any infighting between shareholders and management. More specifically, it isn’t the intention of the D&O policy to act as protection for shareholders as against each other. |

13. Retroactive Date

| In some circumstances insurers may place a limitation on retrospective cover by including a retroactive date in the policy schedule. A retroactive date removes coverage for claims, arising as a result of actions committed before the specified date. | If the retroactive date is the same as the inception date there is no cover for acts prior to the inception date of the policy. |

14. Circumstance

| D&O policies provide for the notification of “a claim, or circumstance that may lead to a claim”. While it may be clear what constitutes a claim eg a statement of claim, letter of demand or similar, a circumstance which may lead to a claim is harder to identify. | How do the directors know whether something will become a claim? It’s important to discuss this with your specialist broker to ensure that notifications are made promptly so the insurer is in a position to react if a claim eventuates. |

1. USE A SPECIALIST BROKER

| Directors and Officers Insurance is a specialised field. Understanding the legislative and regulatory framework and the D&O Insurance market is something a skilled D&O broker is better positioned to do and who should advise the Board. | While the Board and individual Directors might have a preferred broker they have used historically for their operational insurance, that broker may not have the expertise or experience required to negotiate the best D&O insurance renewal terms with the insurers. |

2. START EARLY

| The pre-renewal process needs to start early. By starting early you provide the insurer with enough time to ask any pertinent questions and for the insured to supplement with additional information. There’s a balance between starting early, however, and needing to update the proposal part way through the renewal process because the information has become stale in between the initial submission and the placement. | The optimum renewal period is typically between 60-90 days before expiry. |

3. MEETINGS WITH DIRECTORS & KEY MANAGEMENT

| By starting early, it’s possible to ensure that there is enough time for broker/client meetings for information gathering and also for the insurer to request any meetings they might require with Board members and key management. | By facilitating these one-to -one meetings the end result may well be superior renewal terms than initially contemplated. |

4. STRATEGY FOR RENEWAL

| The Board and the broker should examine the strategy adopted for the D&O insurance in the prior year. Questions to consider include:

|

|

5. HIGH QUALITY SUBMISSION

| A comprehensive submission sent to the underwriter with all relevant information is extremely important. The quality of the information provided to the insurer can be the difference between uncompetitive renewal terms and an attractive renewal. It’s important for the broker to present a balanced submission to the insurer. Considerations for the submission include:

|

|

6. FINANCIAL CONDITION

| With the change in insurer appetite as the market has hardened, there has been an increase in endorsements aimed at protecting the insurer from claims arising in connection with financial collapse for example, broad Insolvency and withdrawal of support. | By starting the pre-renewal process early a broker can obtain the necessary additional information from the insured, relay targeted questions from the insurer and flesh out the publicly available financial information to potentially avoid the inclusion of these onerous endorsements. |

7. MATERIAL CHANGES SINCE LAST RENEWAL

| Completing the proposal form and collating the necessary information early means a detailed submission is prepared for the insurer which can highlight any substantive changes that have occurred since the last renewal. | Key matters that the insurer may consider might be acquisitions which have taken place, expansions into new markets / locations, substantive changes to the shareholder base and large capital raisings (although if these have been above a prescribed threshold they would have been advised to the insurer during the course of the policy period to arrange for inclusion in policy cover). |

8. NEW INSURANCE MARKETS

| By engaging with the incumbent insurer early you may be able to ascertain in general terms what their position on the renewal will be. At the very least you will be forewarned if for any reason they intend to reduce capacity, increase premiums to an intolerable level or at the very worst decline to offer renewal terms. | It’s important for the insured and broker to work together to ensure a comprehensive marketing exercise can be undertaken so that the insured is not left having to accept mediocre terms. Alternative markets do exist and given sufficient time an extensive marketing exercise can help identify these alternatives. |

ASX Corporate Governance Principles and Recommendations – Proposed 4th Edition Amendments

The consultation period for the proposed 4th edition of the Corporate Governance Principles and Recommendations closed on 27 July 2018 with 100 submissions received from interested parties. The period for review of the submissions will end in December with the issue of the 4th edition proposed in Q1 2019 and effective from 1 July 2019. It is contemplated at this stage that ASX listed entities will be required to report against the 4th edition for their first full financial year ending on or after 30 June 2020.

What has driven the corporate governance changes?

The ASX Corporate Governance Council, in its communique, lists a number of factors which have contributed to the timing of this review, These include:

- The changing landscape for listed companies who need to consider the views of a larger stakeholder base to continue to maximise shareholder value and maintain a social license to operate.

- That boards of listed companies need real and tangible support to instill and monitor a governance culture within their organization.

- The increased “internationalization” of ASX listed companies with operations and/or directors operating outside of Australia and thus falling outside the realm of some of the proposed new whistle blowing and anti-bribery legislation.

- Recent governance issues identified in enquiries such as the Hayne Royal Commission and the Senate Economics References Committees, which examined whistle blowing in Australia,foreign bribery and governance concerns raised by ASX during the course of its continuous monitoring.

- Similar reviews being undertaken in a number of other jurisdictions, including: Hong Kong, United Kingdom and Singapore.

What are the recommendations in the 4th edition?

The proposed amendments / new recommendations include (amongst others):

- The recommendation that a listed company obtain independent advice before entering into any consultancy agreement between the company and a director or senior executive (or a related party) and disclosure of the material terms.

- The recommendation that listed companies disclose the process by which they validate their corporate reports to ensure that all market releases are accurate, clear and understandable.

- The recommendation that any company with a non-English fluent director have (and disclose) the processes it has in place to ensure that the director understands and can contribute to board meetings.

- The recommendation that alongside the need to disclose a code of conduct for directors, senior executives and employees, the board is regularly informed of any material breaches of the code and any other material breaches that call into question the culture of the organization.

- The requirement for a periodic review of the skills of existing directors and any need to undertake professional development. This is coupled with enhanced requirements for the induction of new directors.

- Requirements that board composition includes directors with skills in new and emerging issues, i.e. cyber security, digital disruption and sustainability.

- More fulsome disclosure of corporate governance policies (rather than the release of summaries) to ensure there is no omission of material information.

Some summaries of submissions lodged in response to the proposed changes

- The Australian Institute of Company Directors submissions highlight proposed corporate governance amendments in other jurisdictions, such as the United Kingdom and Singapore. This indicates a move away from a compliance “box ticking” exercise to the adoption of a corporate governance practice that will support the long-term growth and success of the business. https://www.asx.com.au/documents/regulation/Australian-Institute-of-Company-Directors.pdf

- The Governance Institute of Australia expressed concerns about the increase in the level of prescription in some of the new recommendations and commentary, as well as the adoption date for the recommendations. They prefer the option of “early adopters” for companies in a position to do so, but require the first companies to report against the 4th edition to be those with December 2019 balance dates. https://www.asx.com.au/documents/regulation/governance-institute-of-australia.pdf

- King & Wood Mallesons noted that the proposed new recommendation relating to directors who are not fluent in the language of the listed company’s meetings might be better dealt with through other methods; for example: the listing conditions which apply to non-Australian domiciled entities on application for admission. They also highlight concerns that the recommendation requiring directors to “have regard” to the interests of other stakeholders (not simply shareholders) is inconsistent with the requirements of Australian Company law, which requires directors to focus on the interests of the Company’s shareholders as a whole. https://www.asx.com.au/documents/regulation/king-wood-mallesons.pdf

- Herbert Smith Freehills submissions highlighted the need to understand the extent of the process of “validation” of corporate reports – whether this contemplates a process as involved as the validation process required for a company when completing its prospectus document, or a simple internal review process with key management. https://www.asx.com.au/documents/regulation/herbert-smith-freehills.pdf

How do these changes in corporate governance relate to Directors and Officers Insurance?

The proposed changes raise some interesting considerations for listed entities when considering their Directors and Officers Insurance

- Some “red flag” concerns for insurers could be alleviated to some extent by companies ensuring they adopt the appropriate processes. For example, companies with operations or board members predominantly based outside of Australia would benefit from adopting appropriate processes for non-English fluent directors. This can include induction processes to ensure they are familiarised with their legal duties and responsibilities under key Australian legislation.

- Disclosure of full policies, especially the continuous disclosure policy, prevents the possibility of an inadvertent omission of material information when summarising these documents and enhances the quality of publicly available information.

- Will the increase in disclosure requirements increase the chances for errors and omissions, and consequently an increase in the possibility of security class action law suits? The plaintiff law firms have targeted these oversights in the past and the changes could make it more difficult for boards to manage.

- Insurers will continue to refer to a company‘s corporate governance statement alongside other publicly available company information when considering the company’s insurance risk profile. As new recommendations are implemented, insurers will consider how their policies respond and any changes they might need to put in place.

- As the corporate governance principles evolve to include emerging issues such as cyber security and digital disruption, companies will need to examine their insurance policies closely to ensure they have the capability to respond to potential claims. If they don’t, companies will need to consider if they should be purchasing a standalone insurance policy to deal with these issues.

Ultimately, any changes which improve the quality and depth of disclosure by listed companies are positive for all stakeholders. Directors considering board positions can review and take some comfort in circumstances where a company’s prevailing corporate governance structure measures favourably against recommendations.

A link to the relevant consultation papers, ASX roadshow presentation and submissions can be found here: https://www.asx.com.au/regulation/corporate-governance-council/review-and-submissions.htm

Climate Change

| The 4th edition of the Corporate Governance Recommendations (released in February 2019) included in its recommendations to listed companies a recommendation that they disclose whether they had any material exposure to environmental or social risks and their approach to managing those risks. The following reference appears as part of Recommendation 7.4:

The Council would encourage entities to consider whether they have a material exposure to climate change risk by reference to the recommendations of the Financial Stability Board’s Task Force on Climate-related Financial Disclosures (“TCFD”) and, if they do, to consider making the disclosures recommended by the TCFD.

Companies who choose to make this disclosure should analyse the potential impact of a number of climate related scenarios (one example being rising temperatures) on the organisation and refer to the plans adopted to mitigate against the risks. | This reporting framework is becoming a topic for consideration, not only by company directors, but also by retail and institutional investors. For example, superannuation funds are influenced by transparent disclosure on climate risks, as well as companies’ policies and strategies in approaching these risks. This scrutiny indicates that these are investment risks that will not be ignored in the investment assessment process, no different to other considerations such as financial metrics and business systemic risks.

Many companies are leading the charge with their TCFD reporting in financial disclosures, as well as aligning executive remuneration and key performance targets with the overall strategy. Institutional investors who are members of collaborative groups, such as the Investor Group on Climate Change (https://igcc.org.au/) and Climate Action 100+ (http://www.climateaction100.org/), are engaging with companies to require them to consider the impact of climate change and release appropriate and comprehensive disclosure about these risks. |

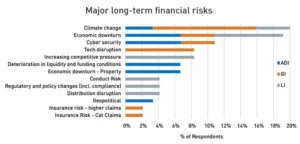

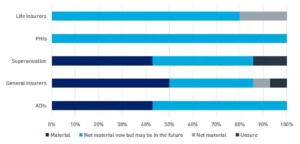

*An APRA survey undertaken last year across Australian banks, general and life insurers listed climate change as the number one long-term financial risk, ahead of economic downturns and well ahead of cyber security. ADI – Australian Deposit-taking Institutions, GI – General Insurers, LI – Life Insurers

Human Rights

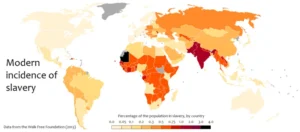

| With this year’s introduction of the Modern Slavery Act, directors will also be considering disclosures pertaining to human rights and assessing the risk of modern slavery at any point in their supply chain or operations. The International Labour Organisation believes that 21 million people worldwide are forced labourers, with half of those in the Asa-Pacific region – a fact that Australian companies will not be able to ignore. | Currently, entities with more than $100 million in revenue will be required to report disclosures relating to human rights due diligence and publish annual modern slavery statements on an online central register. |

*Infographic showing the estimated percentage of population in slavery, by country, as of 2013/14. https://commons.wikimedia.org/wiki/File:Modern_incidence_of_slavery.png

ASIC High Level Recommendations

| ASIC has released a media guideline (available on ASIC website) which provides some high-level recommendations to listed entities, to assist them in their disclosure around climate risk. These include:

|

|

Directors and Officers Insurance

| D&O insurers often respond to significant market events (i.e. the historic and current Royal Commissions) by increasing premiums and including new endorsements to D&O insurance policies. This is generally because these policies reflect the prevailing governance concerns at any particular time. With the increased scrutiny on companies’ disclosures around sustainability risks, including climate change, we would expect to start seeing premiums increase for companies operating in what are perceived as more “risky” business activities, including resources (mining and oil & gas) and industrial operations. We would also anticipate more customised endorsements relating to climate change/emissions and exclusions designed to carve out any responsibility for errors by companies in relation to their TCFD reporting. | Certain insurers, for instance IAG, have made a conscious decision to limit their exposure to entities with carbon intensive industries. Their Climate Action Plan released in October 2018 noted that less than 1% of their premiums covered carbon intensive industries in FY18. This has clear implications for companies operating in this sector. |

*A recent survey conducted by APRA in 2018 across Australia’s largest banks, general, life and health insurers, and superannuation funds found the banking, general insurance and superannuation industries reported the highest awareness of climate risks. Life and private health insurers were less likely to be taking steps to understand the risks, and less likely to view the risks as material to their businesses.

| With increased retail and institutional shareholder attention to these matters, we would expect to see an increase in the potential for securities claims and class actions due to incomplete, inadequate or erroneous reporting. On the flip side, we would like to believe that companies operating in less risky environments/industries and who report against TCFD guidelines and align executive remuneration with climate related measures, will benefit from more competitive premiums and less onerous endorsements.

In a similar vein, with the introduction of the Modern Slavery Act, we believe that retail and institutional investors will be expecting enhanced disclosure by the larger companies obligated to report in accordance with the legislation. However, this will place pressure on smaller Australian listed entities who have any exposure through their supply chain and/or their operations, to make appropriate and comprehensive disclosure. This will then demonstrate that their board is considering this an important business risk and is giving clear guidance on the due diligence conducted by the company, as well as the risk mitigation strategies the company is adopting. Failure to do so will most likely result in increasing scrutiny by shareholders, regulators and other interested parties. Any public censure by regulators or queries and corresponding share price drops may well expose the company to the threat of a derivative class action.

Corrs Chambers Westgarth, in its insight “A new era of climate change litigation in Australia”, identified the key matters which have historically been litigated on (and will continue to be litigated on). These included: | “…challenges to decisions by governments and other regulatory bodies to approve projects and developments which may have significant direct or indirect greenhouse gas emissions. The most obvious of these are projects such as coal mines, coal-fired power stations and gas exploration… Over time, greater focus may fall on projects with direct and indirect emissions that have not yet been as much of a focus of disputes. Those might include, for instance:

In the event that investors suffer a loss which they perceive could be attributed to inadequate disclosure by the board/management of their climate change risks, we believe this could result in a D&O claim. The claim could arise in a number of scenarios:

D&O Insurance is complex and the changing governance framework is making it even more so. Insurers respond to emerging risks quickly and it’s important to stay on top of the important considerations for your D&O policy and keep your broker informed. |